How Trade Contractors Can Take On More Projects with EPP

The construction industry is known for its payment delays, which can have a negative impact on trade contractors' cash flow. This often leads to...

2 min read

Molly Gilson

:

Jun 25, 2025 9:06:36 AM

Molly Gilson

:

Jun 25, 2025 9:06:36 AM

A project is falling behind schedule.

It’s a slow bleed, not a sudden catastrophe. Material deliveries are sporadic, the crew on-site seems smaller than it should be, and your project manager can't give you a straight answer as to why the timeline keeps slipping. You suspect your subcontractor is underperforming.

But what if they aren't the problem? The problem may be originating in your own back office.

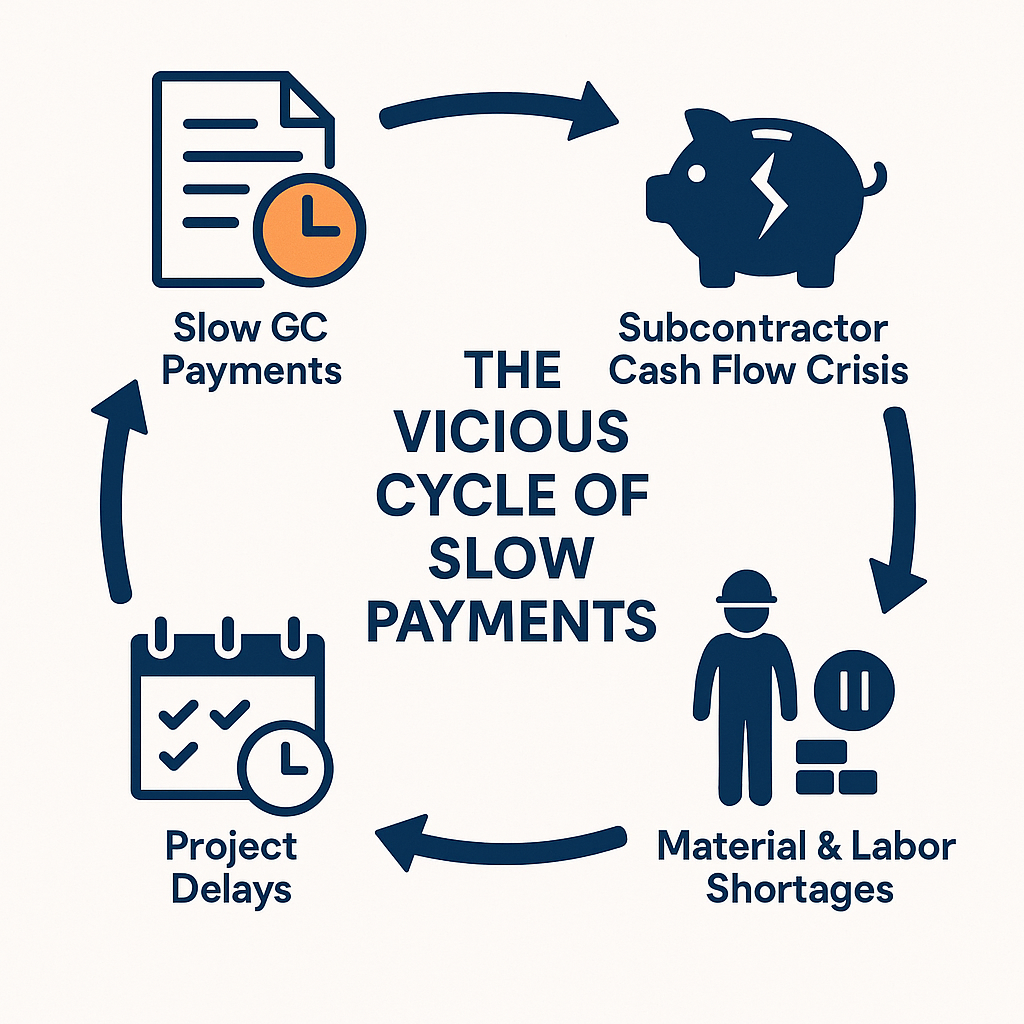

For too many General Contractors, an inefficient construction payment process is a financial stranglehold on their subcontractors. This self-inflicted crisis starves your project of the two things it needs to survive: materials and manpower, leading to significant project delays.

Subcontractors operate on razor-thin margins so when payments are delayed for 60 or 90 days, subcontractors have to float massive upfront costs they aren't equipped to handle. This creates a vicious cycle of delays that directly impacts a General Contractor's profitability.

This isn't just a relationship issue. An inefficient payment process is a direct threat to your project schedule, your budget, and your ability to partner with the best talent.

The good news is that this is a problem you have complete control over. The bottleneck isn't on the job site; it's the stack of paper invoices sitting on a desk, the clunky email approval chains, and the slow, manual process of cutting and mailing checks.

By transforming your payment process from a bottleneck into a fuel source, you can directly improve project outcomes.

This is where Constrafor’s end-to-end platform turns a liability into a strategic advantage.

Your subcontractors' financial health is your project's health. Stop starving your jobs of the cash they need to thrive. A fluid payment process is no longer a "nice to have", it's a core component of modern, efficient project management.

Ready to turn your payment process into a competitive advantage? Schedule a demo with Constrafor today and discover how you can fix subcontractor cash flow issues to keep your projects funded, on schedule, and on budget.

The construction industry is known for its payment delays, which can have a negative impact on trade contractors' cash flow. This often leads to...

2 min read

The construction industry is undergoing a transformation, and adopting accelerated payments can make a substantial difference in your business. By...

1 min read

One of the biggest challenges faced by subcontractors is cash flow. In the excitement to bid on and win a big project that...